The Legal System Surrounding Financial Offshore Tax Planning Approaches

The Legal System Surrounding Financial Offshore Tax Planning Approaches

Blog Article

Recognizing the Significance of Financial Offshore Accounts for Business Growth

In the vibrant globe of global commerce, financial offshore accounts stand as pivotal devices for business development, using not only better currency adaptability however also potential decreases in deal expenses. These accounts help with accessibility to diverse markets, enabling firms to leverage better rate of interest and tax obligation efficiencies. However, the critical implementation of such accounts requires a nuanced understanding of lawful structures to ensure compliance and enhance benefits. This intricacy welcomes further expedition right into how organizations can successfully harness the advantages of offshore banking to drive their growth efforts.

Trick Advantages of Offshore Financial Accounts for Services

While many services seek competitive advantages, the use of overseas monetary accounts can give substantial advantages. These accounts contribute in assisting in international profession by allowing business to take care of multiple currencies a lot more successfully. This ability not just enhances transactions but can also decrease the transaction costs that pile up when dealing with worldwide exchanges. Additionally, overseas accounts often supply better interest prices contrasted to domestic financial institutions, improving the potential for revenues on idle funds.

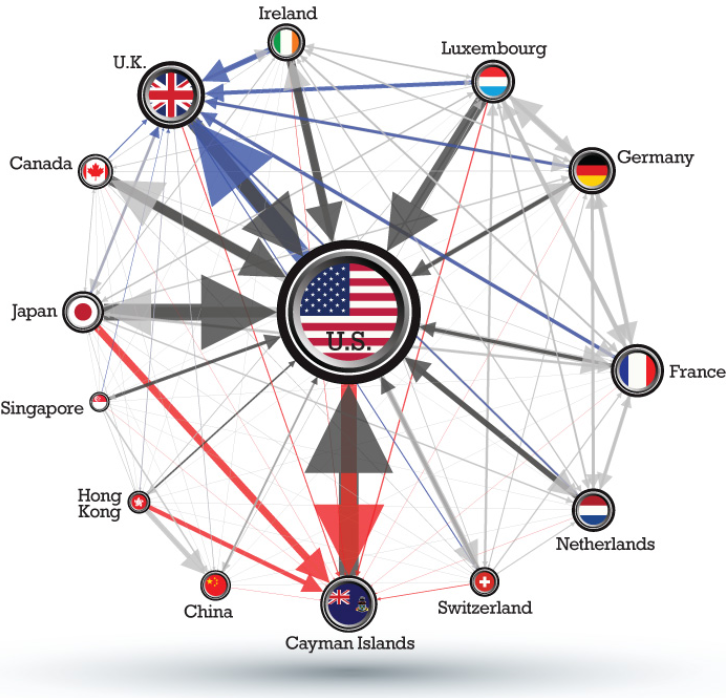

In addition, geographical diversity inherent in offshore banking can act as a danger management device. The personal privacy given by some offshore territories is a vital variable for businesses that focus on discretion, especially when dealing with delicate purchases or exploring brand-new endeavors.

Legal Considerations and Compliance in Offshore Financial

Although offshore economic accounts use various benefits for companies, it is necessary to understand the lawful structures and conformity needs that govern their usage. Each territory has its very own set of regulations and laws that can considerably influence the performance and validity of offshore financial tasks. discover this info here financial offshore. Companies have to guarantee they are not only adhering to the laws of the country in which the overseas account lies however additionally with international monetary laws and the regulations of their home country

Non-compliance can result in serious lawful repercussions, consisting of fines and criminal fees. It is essential for organizations to engage with legal specialists that specialize in worldwide money and tax law to navigate these complicated legal landscapes efficiently. This advice aids make sure that their overseas banking tasks are conducted legitimately and fairly, lining up with both national and global requirements, hence protecting the business's credibility and financial wellness.

Approaches for Incorporating Offshore Accounts Into Service Operations

Incorporating overseas accounts right into service look at this now procedures calls for mindful preparation and strategic implementation. It is necessary to choose the ideal jurisdiction, which not only straightens with the service goals but also offers political and economic stability.

Businesses need to incorporate their overseas accounts right into their general financial systems with transparency to keep trust fund amongst stakeholders (financial offshore). This includes establishing robust accounting methods to track and report the flow of funds accurately. Routine audits and reviews must be carried out to mitigate any threats related to overseas financial, such as fraud or reputational damages. By methodically implementing these strategies, organizations can properly make use of offshore accounts to sustain their growth efforts while sticking to lawful and moral criteria.

Conclusion

In verdict, offshore monetary accounts are vital properties for services intending to expand worldwide. Incorporating them into company operations tactically can significantly improve money flow and straighten with wider organization growth objectives.

In the vibrant globe of global business, monetary overseas accounts stand as critical tools for company development, using not just enhanced currency adaptability however also possible decreases in purchase costs.While numerous organizations seek competitive advantages, the use of offshore financial accounts can give significant benefits.Although overseas economic accounts offer many advantages for businesses, it is crucial to comprehend the lawful structures and compliance needs that regulate their use. Organizations have to guarantee they are not only abiding with the laws of the country in which the overseas account is located however likewise with global financial policies and the laws of their home nation.

Report this page